A Company Purchased $4 000 Worth of Merchandise

View the full answer. If the profits increase 2 from the previous month in what month will the machine be completely paid off.

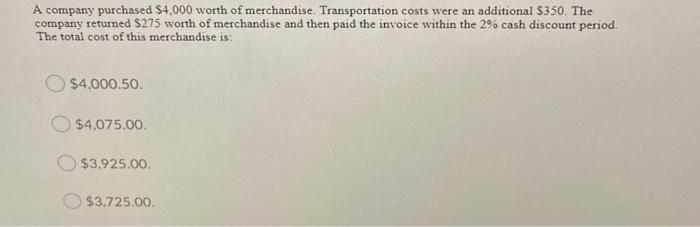

Exam 2 Practice Questions 1 Abc Company Had Expenses Other Than Cost Of Goods Sold Of 300 000 Studocu

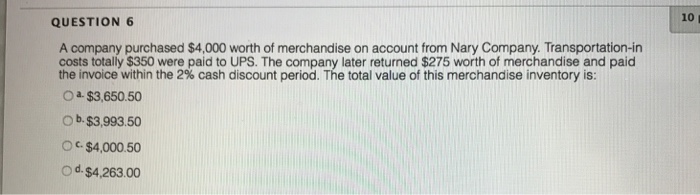

Transportation costs were an additional 350.

. Goods worth P1000 were returned on October 2 and the account was paid on October 3. Transportation costs were an additional 350. Business Accounting QA Library On December 1 2019 Insto Photo Company purchased merchandise invoice price 25000 and issued a 12 120-day note to Ringo Chemicals Company.

On July 1 Ferguson Company sold merchandise in the amount of 5800 to Tracey Company with credit terms of 210 n30. Insto uses the calendar year as its fiscal year and uses the perpetual inventory system. A company paid 110000 for a new 18-wheeler.

On May 1 Shilling Company sold merchandise in the amount of 5800 to Anders with credit terms of 210 n30. 4 At Dicksons request paid 350 for freight charges on the August 1 purchase. The cost of the items sold is 4000.

Write the value of the trick V as a function of its age in years n. Find the function and the value when the truck is 4 years old. 1 pa A company purchased 4000 worth of merchandise.

Transportation costs were an additional 350. Mekhanik 12K 1 year ago. On July 5 Tracey returns some of the merchandise.

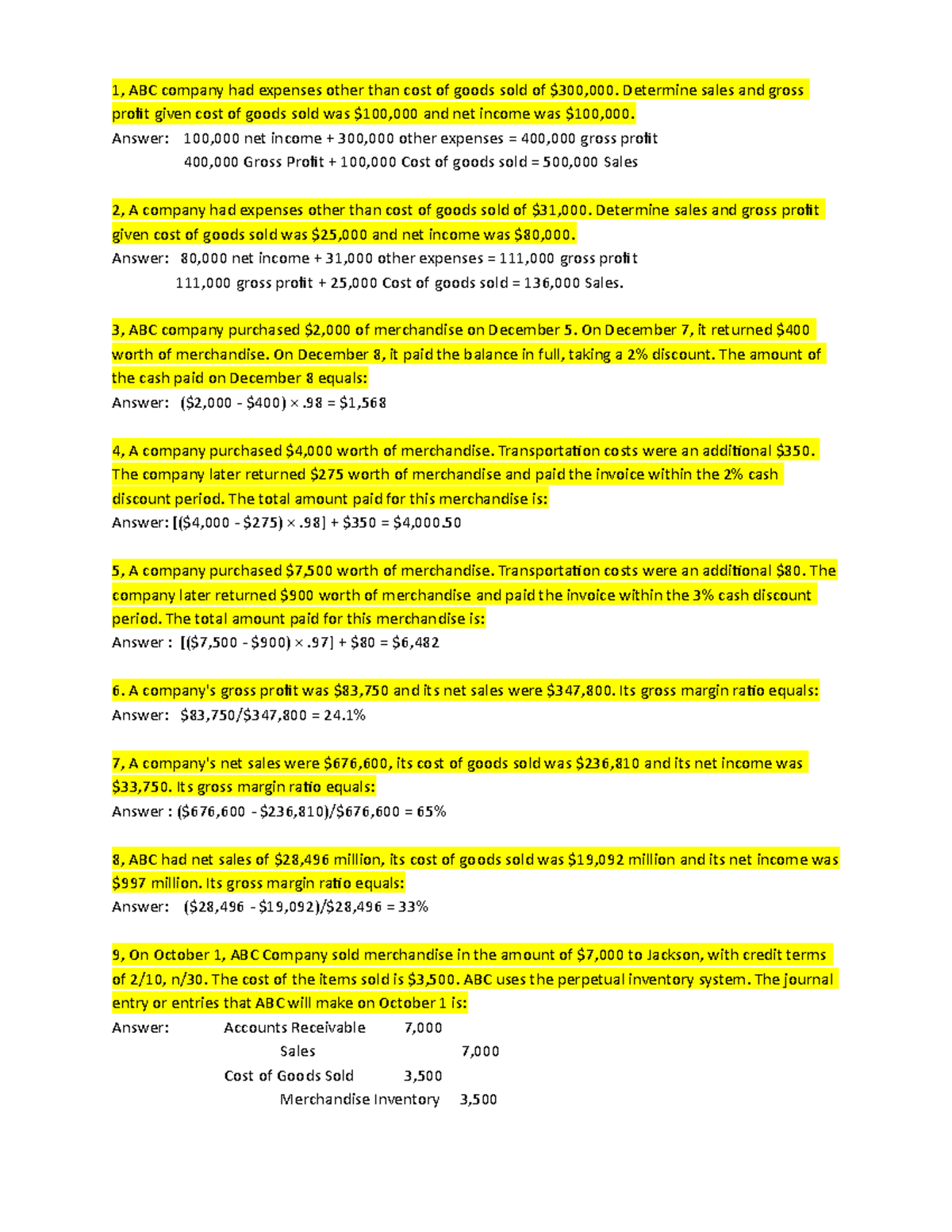

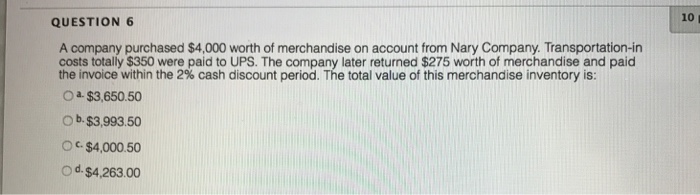

A company purchased 4000 worth of merchandise. The total amount paid for. Transportation-in costs totally 350 were paid to UPS.

On October 1 XYZ Company purchased P6000 worth of goods on terms of 215n30. Defective inventory of 70 000 was returned 2 days later and the accounts were appropriately adjusted. Shilling uses the perpetual inventory system and the gross method.

The company later returned 275 worth of merchandise and paid the invoice within the 2 cash discount period. Use a separate account for each receivable and payable. Accounting questions and answers.

For example record the purchase on August 1 in Accounts Payable _ Dickson Company. On February 3 Smart Company sold merchandise in the amount of 5800 to Truman Company with credit terms of 210 n30. A company purchased 4000 worth of merchandise on account from Nary Company.

Prepare journal entries on Instos books to record the preceding. Transportation costs were an additional 350. - account rec 5800.

The company later returned 275 wort. The company later returned 275 worth of merchandise and paid the invoice within the 2 cash discount period. Using straight-line depreciation the value of the trick in dollars V is a linear function of its age in years n.

A company using the perpetual inventory system purchased inventory worth 540 000 on account with credit terms of 215 n45. During the month of February Metro Corporation earned a total of 50000 in revenue from clients who paid cash. Profits in March were 7876.

The cost of the items sold is 4000. Selling services for cash. If the company paid the invoice 20 days later the journal entry to record the payment would be ________.

XYZ company purchased a new machine in March at 50000 and is using the profits to pay it off. A company purchased 4000 worth of merchandise. Giorgio Italian Market bought 4000 worth of merchandise from Food Suppliers and signed a 90-day 6 promissory note for the 4000.

Aroma Company used the net price method of accounting for cash discounts In one of its transactions on December 262021the entity sold merchandise with a list price of P5000000 to a customer who was given a trade discount of 2010 and 5Credit terms were 410n30. Sales 5800 - sales 5800. The total value of this merchandise inventory is.

7 Purchased merchandise from Dickson Company for 4 000 under credit terms of 1 10 17 30 FOB destination. The company returned 275 worth of merchandise and then paid the invoice within the 2 cash discount period. The company paid the invoice within the 2 cash discount period.

The total amount paid for this merchandise is. What does the 210 stand for. Transportation costs were an additional 350 paid directly by the company to UPS not considered in the discount since paid directly in cash.

The total amount paid for this merchandise is. A company purchased 4000 worth of merchandise. What does the 210 stand for.

Transportation costs were an additional 350 paid directly by the company to UPSnot considered. Transportation costs were an additional 350. The cost of the items sold is 4000.

A company purchased 4000 worth of merchandise. Can you explain how you did the math. The total cost of this merchandise is.

The company later returned 275 worth of merchandise and paid the invoice within the 2 cash discount period. The company later returned 250 worth of merchandise and paid the invoice within the 2 cash discount period. A company purchased 4000 worth of merchandise.

Smart uses the perpetual inventory system and the gross method. 5400050 E 407500 Atter preparng and. Assets 30200 Cash 13900 Supplies 500 Prepaid Rent 1800 Equipment 5500 Truck 8500 Liabilities 200 Equity 30000.

When it is 9 years old it will be worth 20000. Question 3 4 4 pts On April 1 our company purchases 1000 worth of merchandise inventory on credit with the terms 2 10 n 30. A company purchased 4000 worth merchandise.

Truman pays the invoice on February 8 and takes the appropriate discount. Question 2 4 4 pts We purchase merchandise on account with the credit terms 2 10 n 30. Freight of P500 was prepaid by the seller under the term FOB shipping point.

H of merchandise and paid the invoice with the 2 cash discount period. The new accounting equation would be. Transportation costs were an additional 350 The company returned 275 worth of merchandise and then paid the invoice within the 2 cash discount period The total cost of this merchandises O A 5372500 B.

50000 7876 635 We have only few values to calculate so let us make a table of. The journal entry or entries that Shilling will make on May 1 are. Food Suppliers journal entry to record the collection on the maturity date is.

Ferguson uses the perpetual inventory system and the gross method. The total amount paid for this merchandise is. A company purchased 4000 worth of merchandise.

Solved A Company Purchased 4 000 Worth Of Merchandise On Chegg Com

Solved A Company Purchased 4 000 Worth Of Merchandise Chegg Com

Solved A Company Purchased 4 000 Worth Of Merchandise Chegg Com

0 Response to "A Company Purchased $4 000 Worth of Merchandise"

Post a Comment